In the evolving landscape of global finance, adherence to regulatory mandates such as the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA) is paramount. These frameworks are at the forefront of international efforts to combat tax evasion and enhance the transparency of financial transactions across borders. However, for financial institutions operating in multiple jurisdictions, these regulations present a maze of complexities and compliance challenges.

The Challenge at Hand

The intricate and ever-changing nature of CRS and FATCA regulations requires businesses to stay abreast of updates and adapt their compliance strategies accordingly. With requirements varying from one country to another, the task of understanding and implementing these rules can be daunting. Non-compliance is not an option, as it can lead to severe financial penalties, reputational damage, and legal repercussions.

How RegTech Solutions Can Help

In this digital age, leveraging technology is not just an option; it’s a necessity for efficient and effective compliance. RegTech solutions offer automated tools for data collection, validation, and reporting, significantly reducing the potential for error and improving compliance efficiency.

The MAP FinTech Advantage

At MAP FinTech, we understand the intricacies of CRS and FATCA reporting. Our comprehensive suite of reporting services is designed to alleviate the burden of compliance, allowing financial institutions to focus on their core business activities.

Key features of our offering include:

- Cost-efficient Reporting Solutions: Integrated under a single platform for ease and efficiency.

- Highly Automated and Scalable Solutions: Capable of managing accounts in large volumes, regardless of size.

- Flexibility in Data Collection: Accommodating standard templates or raw data input.

- Robust Reporting Health Checks: Ensuring accuracy in both content and schema, with automatic filtering of erroneous entries.

- Automatic conversion of data to XML and separation of files based on tax residency.

- Submissions to various tax authorities worldwide.

- Regulatory Update Compliance: Continuous communication with regulators to reflect the latest changes and updates.

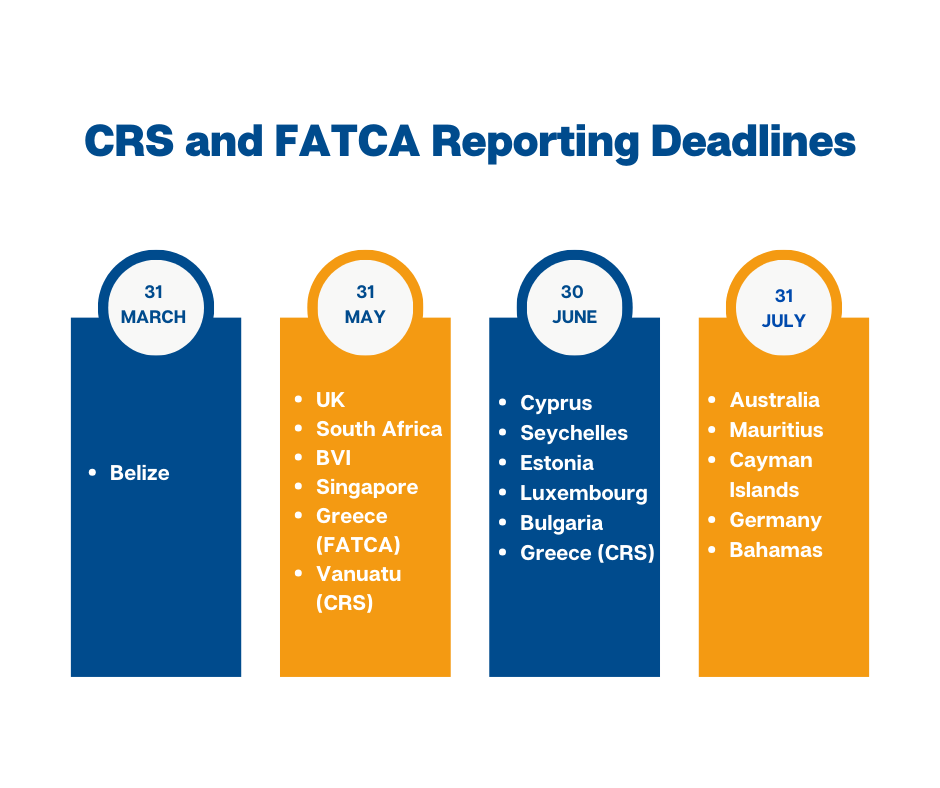

As shown below, the reporting deadline to the relevant tax authorities in most participating jurisdictions is either near or already underway in some jurisdictions.

The importance of being prepared cannot be overstated. With MAP FinTech’s RegTech solutions, businesses can ensure they meet their reporting obligations efficiently and effectively, avoiding the pitfalls of non-compliance.

Please feel free to contact our team of experts for more information or to schedule a consultation.